A new week has started and nothing compelling happened that would induce me to change my mind. I am staying on the sidelines. There are a few stocks that look great and I continue to replenish my public list. Today I added AMZ.V – Amazon Mining. A Brazilian potash play with great potential and a strong looking chart. Check the sector overview chart for additional Fertilizer Stocks.

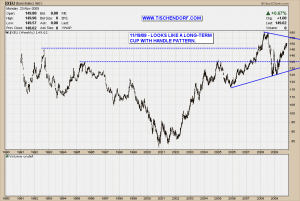

As I recently redrew and updated the Euro chart on my public list I am going to talk about currencies. Check below for both long-term Euro and USD Dollar charts. The Euro chart is now getting more bullish. Especially so for the mid to long-term. The chart is either shaping up as a long-term cup with handle pattern or a big ascending triangle. Both patterns have bullish implications as the price move leading into the triangle pattern was a move to the upside. A break out of the triangle should resume the direction of the trend leading into the pattern. Technically speaking a break out to the upside therefore is the path of least resistance.

That said the formation of the rather big triangle pattern will take more time to complete. A pullback – even a shallow one – means the USD$ Dollar will bounce. That’s when I would expect gold and gold mining stocks to pull back in order to gather strength and build up some pattern pressure to offer long position entries. I don’t know when it will happen. I don’t even know if it will happen. But that’s what I see in the charts and I am patiently waiting for the patterns to set up.

Up-to-date Euro Chart on my public list.

Up-to-date USD$ Dollar Chart on my public list.

For additional currencies check my Currencies Sector Overview Chart that includes the: USD Dollar, Euro, Japanese Yen, Canadian Dollar, Swiss Franc and the Australian Dollar.

Have a great evening!

{ 5 trackbacks }

Comments on this entry are closed.