A new investment theme is starting to emerge. I am talking about Tesla’s ‘Gigafactory’ that is going to be built in Nevada. Tesla is going to significantly ramp up Lithium battery production. TSLA the stock is trading very close to its all time high. KNDI – Kandi Technologies a much smaller Chinese play is one to keep on the radar as well. Outright buying TSLA at all time highs as a means to play that theme is a valid approach. But there are other ways to play that theme. They are riskier but they also offer a lot of potential. Tesla will need Lithium and Graphite in order to build those batteries. I see lots of talk about Tesla being perceived as a ‘patriotic’ company which implies they will prefer domestic suppliers. Nobody knows if that will turn out to be the case but it makes sense to take a closer look at potential candidates for Lithium and Graphite supply.

The two stocks that come to mind are WLCDF / WLC.TO – Western Lithium USA which has properties in Nevada and GPH.V / GPHOF – Graphite One Resources with properties in Alaska. I won’t go much into details and will focus on the charts instead. One thing to keep in mind though is the fact that 10 to 30 times more Graphite than Lithium is needed to build a lithium battery that goes into an electric vehicle. I bought both above mentioned stocks along with NGC.V / NGPHF – Northern Graphite.

Here’s my detailed technical take on each individual stock mentioned above and both the Lithium and Graphite sectors.

Click on Weekly WLCDF – Western Lithium USA chart to enlarge:

The weekly chart clearly shows huge potential with the long rounding bottom base suggesting a price target in the 1.50 – 1.60 area.

Click on Daily WLCDF – Western Lithium USA chart to enlarge:

The daily chart shows a healthy volume pattern and indicates potential for WLCDF to become a high-flyer once former resistance gets taken out.

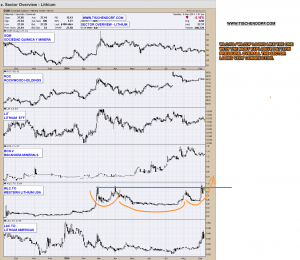

Click to enlarge the Lithium Sector Overview Chart:

The overall sector strength within the Lithium sector is validating the bullish thesis for WLCDF. WLCDF displays an inverted bullish head and shoulders pattern within the right handle of the bigger bottoming formation. The chart contains the following stocks: SQM – Sociedad Quimica Y Minera, ROC – Rockwood Holdings, LIT – Lithium ETF, BCN.V – Bacanora Minerals, WLC.TO – Western Lithium USA, LAC.TO – Lithium Americas.

Two Lithium related links from the old days: Lithium Mining Stocks + Lithium ETF Overview

Click on GPH.V / GPHOF – Graphite One Resources chart to enlarge:

Technically speaking the weakest of the three. But the volume pattern is telling and if the investment theme gets some traction this one could be very interesting. This is truly a high risk, high potential stock.

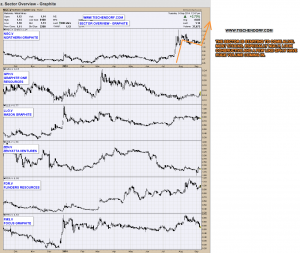

Click on the Graphite Sector Overview chart to enlarge:

The sector is starting to looking constructive. The chart contains the following stocks: NGC.V – Northern Graphite, GPH.V – Graphite One Resources, LLG.V – Mason Graphite, ZEN.V – Zenyatta Ventures, FDR.V – Flinders Resources.

Click on NGHPF – Northern Graphite chart to enlarge:

NGPHF / NGC.V Northern Graphite is displaying a volume pattern that doesn’t get much more bullish than this. Thrusting move on huge volume. Nice round number support at the 1 $ level. When volume comes back into the stock the uptrend should resume with conviction.

There are definitely times when you don’t want to get in front of a bullish freight train or catch a falling knife. If one doesn’t get you the other one will. The crowd is right during the trends, but wrong at both ends. – Bernie Schaeffer

Twitter: https://twitter.com/Tischendorf

Investing in your education always pays. Learn how to read chart patterns like a pro! Tischendorf Letter Premium: https://members.tischendorf.com