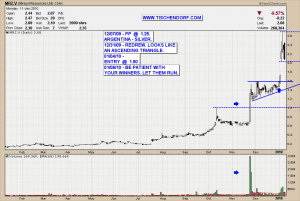

Although I would have expected MRZ.V – Mirasol Resources to close somewhat higher today, overall the stock is behaving extremely well. Last year VEN.TO – Ventana Gold was the stellar performer everybody was talking about. New stars will emerge and have their moment of fame and be in the limelight. Who knows, maybe MRZ.V is the one to shine in 2010. The stock has outstanding potential and today’s news is confirming this assumption. The recent gap should act as support as I don’t consider it to be an exhaustion gap.

So far it looks like MRZ .V – Mirasol Resources is establishing a new trading range above 2.00 CDN$. This one is a winner. My job as a technical trader is to be patient with my winners. Winners take care of themselves. My plan is to hold on to my position as long as I possibly can. The chart will be my guide.

Up-to-date MRZ.V – Mirasol Resources chart on my public list.

MXI.V – Merrex Gold my other portfolio position so far is holding up very well. I particularly like the fact it is starting to build pressure trading slightly below a significant round number. If the stock can take out the 1.00 CDN$ level it could really move. Chartwise everything tells me this is a high probability outcome. Now it depends on how the next set of news will look like. You know the name of the game. The chart is saying odds for good news to come are extremely high. I don’t know how single trades will pan out. But as long as I focus on proper execution a high number of trades will make sure I will come out ahead. The MXI.V – Merrex Gold chart looks great. Pressure is building.

Up-to-date MXI.V – Merrex Gold chart on my public list.

Some more thoughts on a few select stocks of interest:

- SEED – Origin Agritech: Stock is displaying incredible strength. I would expect some more consolidation. Then we will probably witness the true breakout towards the 20$ area.

- QEC.TO – Questerre Energy: Stock is looking good. The 3.50 level is resistance though. Furthermore the recent move looks like a completed ABC move. I wouldn’t be an aggressive buyer here.

- TNG.V – Transgaming: A new addition which is not resource related. Chart looks excellent. I am waiting for clues from the overall markets. I do not want to be aggressive right now.

- SIO.V – Sensio Technologies: Today’s action doesn’t exactly look like a healthy one. The wedge pattern is still valid though. Absolutely no need to rush things with that one. Stock needs more time.

- BSK.V – Blue Sky Uranium: I like the chart and I like Argentina. The stock needs more time to develop pressure though. Definitely one to keep on the radar.

- BCG.V – Brazilian Gold: The stock is starting to shape up. I want more pressure to build. Being patient.

Trade what you see, not what you want to see.

Have a great evening!

{ 3 trackbacks }

Comments on this entry are closed.