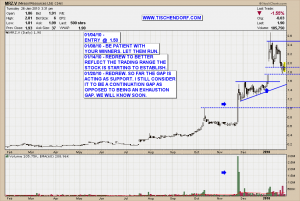

Decided to write a bit more about my thoughts and what I see looking at the MRZ.V – Mirasol Resources chart. In a previous post I was talking about the new trading range MRZ.V is trying to establish. The stock has subsequently dipped further down into the gap zone than initially expected. Today the stock was able to print a few trades around the 2.00 level. It is very tough to decide how overhead resistance above the 2.00 level will influence the stock’s trading behaviour going forward. I do not consider all the trades after the recent gap to be distribution as volume wasn’t overly excessive. We didn’t even come close to see blow-off type volume. Due to the lack of huge volume after the recent gap, technically speaking this increases the odds we witnessed a continuation gap indicating we have further to go until the stock tops out. Exhaustion gaps typically occur when euphoria reaches extreme levels. It is usually a last gasp up which coincides with short sellers giving up and covering their position. I don’t see that with MRZ.V.

Applying technical analysis is not about finding the holy grail. It is a means to gauge odds and to increase one’s discipline. It is also a great way to identify winning stocks. So far MRZ.V still fits the criteria of a winning stock with the potential for future price increases. It will soon be decision time. The longer it takes for the stock to move up again the lower the odds my assumptions will turn out to be right. Trading has nothing to do with loyalty. If a stock doesn’t behave well and doesn’t make me money my job is to get rid of it. No hard feelings. Plenty of other stocks out there. Also review Ed Seykota on trend trading. This will reinforce good trading habits.

Up-to-date MRZ.V – Mirasol Resources chart on my public list.

Conclusion: I still think MRZ.V – Mirasol Resources has the potential to develop into a huge winner in 2010. The next bounce in the resource stocks sector will separate the wheat from the chaff. Closing above 2.20 would roughly correspond to a 10% move to the upside. That would take care of overhead resistance. The stock needs to show its hand soon. A close above 2.00 would be the first step. Let’s see what happens.

When a stock doesn’t move as expected, get out. No hard feelings.

Have a great evening!

{ 1 trackback }

Comments on this entry are closed.