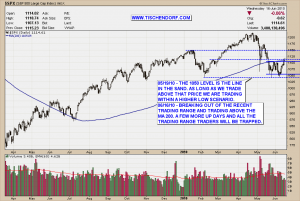

The S&P 500 Index right now is trading back above its moving average 200. To make things worse for bears the S&P 500 has now also broken out of its recent trading range. The reason why I put on two positions in order to test the markets is because the market started displaying an unwillingness to move lower. Strong stocks were starting to act well and I was starting to find more and more stocks setting up for a move to the upside. Reasons for a move to the upside are slowly starting to add up.

It is way too early to tell but I am slowly starting to see the possibility for the market to set up a trap. The traders that will be trapped are the ones who are betting on the recent trading range. They shorted the upper trading range and are betting on prices to fall back into the trading range. A few more up days and they will need to close their positions. We are not there yet and there is no reason to be really aggressive but it is a situation that would provide the necessary fuel for a decent move to the upside. Trade what you see, not what you think.

Here’s the updated chart of the S&P 500 Index with the recent trading range and the MA 200:

Up-to-date S&P 500 daily chart on my public list.

And oftentimes excusing of a fault doth make the fault the worse by the excuse. – William Shakespeare

My public list with all my charts can be viewed here:

http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID2791469

Buenas noches!