The gold mining stocks are not looking good. Most senior miners keep going down and are threatening to go down even further. One notable exception that comes to mind is KGC – Kinross Gold. It is displaying technical strength as it is already putting in more pronounced higher lows. I will post a chart analysis of KGC soon.

So far the HUI Gold Bugs Index is acting weak. Overall I think we will ultimately witness a turnaround and end up printing much higher prices. Stocks like KGC are implying odds for such an outcome are increasing by the day.

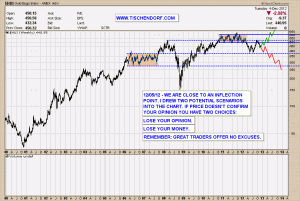

Up-to-date HUI – Gold Bugs price chart on my public list

Conclusion: I am a trader. I do have strong opinions but I do change my mind when price action tells me to do so. No hard feelings. The annotations on my chart are unambiguous. When price doesn’t confirm your opinion you do have a choice. You either lose your opinion or you lose money. In any case, don’t even think about offering excuses. Great traders never offer excuses.

Never force a relationship. If somebody doesn’t want to stick with you, take it as a signal that you are better off without them.

I have reviewed and updated most public list charts. All sector overview charts are now available again.

Charts: www.stockcharts.com/public/1109839/tenpp