If you follow me on Twitter you will have noticed my latest tweet on what to expect during uptrends and downtrends:

TA 101: In downtrends, surprise moves tend to be to the downside $GDX $GDXJ In uptrends, surprise moves tend to be to the upside $IBB $XBI

— Olivier Tischendorf (@Tischendorf) March 8, 2015

This is my 17th year trading the markets. The above statement is the essence of what I am experiencing on a daily basis. In order to get exposure to potential super winners you have to identify the right pond to fish in. Then cast your line in that pond and ignore all other ponds. As far as trading is concerned my job is to identify the strongest sector, to stick to the charts and to seek maximum exposure to that sector. I then keep doing that until it stops working.

Right now, the only game in town is Biotech. As long as fishing in that pond yields good results I will keep doing it. It goes without saying the party won’t last forever, but looking at the charts, the great majority of Biotech stocks do look extremely constructive and odds are they have a lot more room to run until the bubble bursts.

If the bull move continues, I highly suspect the Biotech sector will produce some spectacular winners like TSLA – Tesla Motors. Everybody wants to own and profit from potential super winners. But nobody wants to do their homework. And certainly nobody wants to go through the tough part of Embracing Ambiguity. That’s why most traders never end up owning these super stocks.

These are the characteristics of monster winners and why it is so difficult to buy them and hold them all the way up:

- Their business is most often new and unproven

- There is a lot of ‘information risk’, nobody knows if the company will make it

- The stock is printing new all time highs

- Price is extended and it feels like chasing

- No earnings, no value in the traditional sense, the stock is extremely expensive

As you can see, there is only one way to own these type of companies. You have to be able to Pull the Trigger and assume full responsibility for your actions in an environment that is characterized by extreme uncertainty. Nobody can help you pull the trigger. You either do it or you are out. As I have said quite a few times in the past:

Great traders offer no excuses. They assume full responsibility for all their trades.

Here is how the weekly TSLA – Tesla Motors chart looked like before it proceeded to run up to above US $280. Click to enlarge:

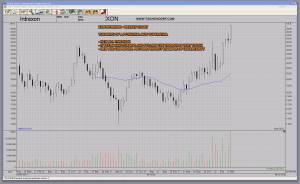

Super stock performance produces superstars. I am pretty much convinced the Biotech sector will produce a superstar similar to Elon Musk. Maybe it is going to be a guy like Randal J. Kirk the CEO of XON – Intrexon. It really doesn’t matter. My point is, the stars are aligned for the Biotech sector to produce a cult figure. To make a long story short, XON has the look. The time is right, as it is part of the strongest sector around. Interestingly the chart looks very much like TSLA did a while back before it started its monster run.

Intrexon has huge story stock potential. The company could emerge as the leader of the ‘Bioindustrial Revolution’ one of the most compelling investment themes around. If you want to dig deeper, two companies with very bullish looking charts it has collaboration agreements with are: ZIOP – Ziopharm Oncology and SYN – Synthetic Biologics.

Click on the weekly XON chart to enlarge:

Conclusion: It simply doesn’t get more bullish than that. This is actionable advice as opposed to hindsight analysis where the results are always 20/20. That’s precisely why there are no guarantees this trade will actually work. What I do know though is the following: Get exposure to the very best stocks in the very best sector. Take lots of small trades. Don’t bet the farm. Manage risk. Stick to the process. Assume full responsibility. Over time you will be rewarded.

XON – Intrexon company profile from Yahoo finance:

Intrexon Corporation, a biotechnology company, operates in the synthetic biology field in the United States. The company, through a suite of proprietary and complementary technologies, designs, builds, and regulates gene programs, which are DNA sequences that consist of key genetic components. Its technologies include UltraVector gene design and fabrication platform, and its associated library of modular DNA components; cell systems informatics; RheoSwitch inducible gene switch; AttSite Recombinases; protein engineering; mAbLogix; and laser-enabled analysis and processing. Intrexon Corporation has collaboration agreements with ZIOPHARM Oncology, Inc.; Synthetic Biologics, Inc.; Oragenics, Inc.; Fibrocell Science, Inc.; Genopaver, LLC; AquaBounty Technologies, Inc.; S & I Ophthalmic, LLC; Biological & Popular Culture, Inc.; OvaXon, LLC; Intrexon Energy Partners, LLC; and Persea Bio, LLC. The company was formerly known as Genomatix Ltd. and changed its name to Intrexon Corporation in 2005. Intrexon Corporation was founded in 1998 and is based in Germantown, Maryland.

It takes effort to create the kind of disciplined approach that is necessary to become a consistent winner. – Mark Douglas

Twitter: https://twitter.com/Tischendorf

Investing in your education always pays. Learn how to read chart patterns like a pro! Tischendorf Letter Premium: https://members.tischendorf.com

{ 2 trackbacks }

Comments on this entry are closed.