A few months back I created a sector overview chart containing China ETFs and Shanghai A-Share ETFs. The huge move in the Shanghai Index SSEC looks like a long-term breakout implying much higher prices down the road.

No matter what happens in the long run, the short to intermediate term outlook looks very bullish as the charts are setting up in ABC move fashion. The uptrend leading into the recent consolidation pattern should resume anytime.

Click on the Shanghai Index chart to enlarge:

Always up-to-date SSEC Shanghai Stock Exchange chart on my public list.

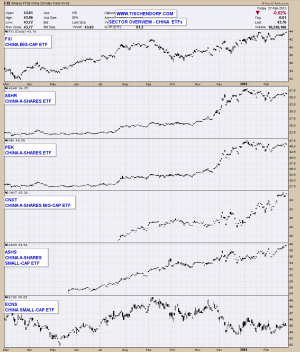

Click on the China ETF Sector Overview chart to enlarge:

Always up-to-date China ETF Sector Overview chart on my public list.

The China sector overview chart contains the following ticker symbols: FXI, PEK, ASHR, CNXT, ASHS, ECNS

Click on the CAF Morgan Stanley China A Share Fund chart to enlarge:

As you can see in my chart annotations there is overall pattern pressure combined with immediate pattern pressure. The chart has built a long-term bottoming pattern and the recent run-up is most likely the first leg of an ABC pattern. Odds are very high for the uptrend to resume soon. The pattern offers a price target around 40$ which coincides with a former significant price high. On a break out to the upside this former high will most likely act as a price magnet therefore increasing the odds of the 40$ price target to be met.

If you want to know everything about the market, go to the beach. Push and pull your hands with the waves. Some are bigger waves, some are smaller. But if you try to push the wave out when it’s coming in, it’ll never happen. The market is always right. – Ed Seykota

Twitter: https://twitter.com/Tischendorf

Investing in your education always pays. Learn how to read chart patterns like a pro! Tischendorf Letter Premium: https://members.tischendorf.com

{ 1 trackback }

Comments on this entry are closed.