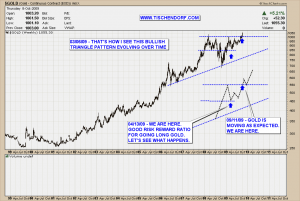

A week ago I wrote about the future outlook for gold. We have now significantly breached the 1.000 USD$ level and price is moving according to the bullish scenario outlined on the weekly gold chart on my public list. The most bullish scenario would be as much separation as possible from the 1.000 $ level with a subsequent pullback towards the 1.000 $ area. The price would not necessarily need to touch the 1.000 USD$ price level again. If the price of gold then moves up again and takes out whatever high it made during the initial separation move that is going on right now we should be on our way to much higher gold price targets. Let’s see how things are going to develop.

Up-to-date Weekly Gold Chart on my public list.

A few thoughts on some stocks in my portfolio and some that I am closely monitoring:

- MRGE – Merge Healthcare: Stock is slowly setting up for a break-out to the upside. I am looking to possibly reenter that one soon. MRGE chart.

- CAST – ChinaCast Education: Stock is the leader in the Chinese Education Sector. Very bullish action. Looking to possibly open a position soon. CAST chart.

- BXI.V – Bio Extraction: Volume is not kicking in yet. But odds have increased for the consolidation to be over soon. This one wants to go to 2.00$. BXI.V chart.

- LSG.TO – Lake Shore Gold: LSG.TO and WTM.TO – West Timmins Mining are moving up again. I am only watching LSG.TO as the companies will merge soon. Volume today was huge. My best guess would be it won’t break out of the ascending triangle immediately as I can’t see even more volume coming into the stock. This one looks good again. Looks like it will move higher over time. LSG.TO chart.

- RES.V – Rare Element Resources: Maybe it’s because of the gold business RES.V is involved in maybe it’s because of their recent REE property acquisition. Somehow this stock is holding up much better than it’s REE peers. I wouldn’t be surprised if one day huge volume comes in and the stock moves up to 5$. This one has great upside potential. Keep in mind the extremely tight share structure. We still haven’t seen any kind of blow-off volume spike. That’s why I am still very bullish on that one. RES.V chart.

- VEN.TO – Ventana Gold: The superstar in the gold mining exploration sector. Not much I have to add. I see much higher prices down the road. Ultimately the stock will be taken out by a major. This will add another 20% or more to the share price. As long as they keep coming up with good drill results I am not selling a single share. VEN.TO chart.

Have a great evening!