More of the same for tonight. I’ve talked a lot about the bearish patterns developing in the gold and silver mining stocks. The only metric that counts is price. The miners were displaying red flags for months as the price of gold was making new highs but the miners didn’t print new highs. Only at the very end of gold’s move towards 2000 did the miners finally start to move up. Once gold retreated the miners put in nasty breakaway gaps to the downside trapping all the bulls. Loading up all the way down because you think the miners are a bargain is an extremely dangerous proposition. You can be successful with this “strategy” for a large period of time. In the long run though you will end up being wrong. You only need to be wrong once, and you’re done. No more capital to trade with. Out of the game.

- My best advice has always been and will always be: Kill your greed. Learn technical analysis. Control your risk. Think independently.

As you know by now, I stick to Technical Analysis. I do have strong opinions regarding fundamentals. But my ultimate buy and sell decisions are exclusively based on what the charts tell me to do . I repeat: I allocate money according to what the charts tell me to do. Period.

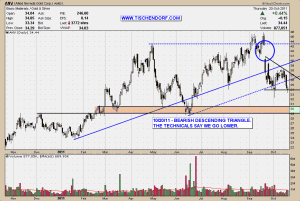

I mentioned the ‘Hole in the wall pattern’ with EXK – Endeavour Silver and also did a Video Analysis of GDX and GDXJ. Tonight I updated the chart of ANV – Allied Nevada Gold on my public list. Same story as with all the other gold miners. Gap down. The attempt to close the gap down failed miserably as price fell sharply during the past two days. A new pattern is now emerging. A bearish descending triangle which has to be considered a bearish continuation pattern.

Up-to-date ANV – Allied Nevada Gold price chart on my public list.

The technical picture is unambiguous: The path of least resistance is now down. Sellers are in control. This simply means odds favour lower prices ahead. Remember: When the path of least resistance is down surprises tend to be to the downside. AEM – Agnico Eagle Mines got killed. LSG.TO – Lake Shore Gold has been taken to the woodshed. TRX – Tanzanian Royalty Exploration is getting destroyed. UXG – US Gold is clearly in a stage 4 downtrend as defined by Stan Weinstein. The list goes on… Just a few examples of what to expect when the technicals deteriorate across the board.

First they ignore you. Then they laugh at you. Then they fight you. Then you win. – Mahatma Ghandi

My public list with all my charts can be viewed here:

http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID2791469

Buenas noches!