The S&P 500 chart is starting to hit strong resistance. That’s the chart annotation I added to the daily S&P 500 chart on my public list yesterday. Today we saw price getting rejected. Apart from the technicals I keep seeing stocks like AAPL – Apple and now AMZN – Amazon getting killed after they announce their earnings. My point is: It doesn’t even matter what they announce, it’s the reaction to the news that counts. The way stocks get punished doesn’t want me to get long. I still think it’s only a matter of time until the bear market develops its full force.

Granted, the price action during the recent weeks might suggest otherwise, but I’d rather be wrong and stay mostly in cash or being short as opposed to getting caught in a vicious down move with aggressive exposure the long side.

Here are a few charts of the S&P 500 that suggest we are indeed in a bear market and recent price action is nothing more but a reprieve until the real action unfolds. Although we could still see an S&P 500 rally into Christmas in the grand scheme of things it is best to be aware of Bear Market Trading Rules.

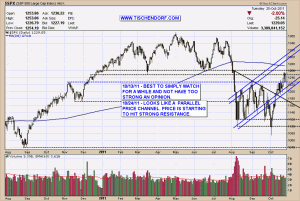

Up-to-date S&P 500 daily price chart on my public list.

As you can see in the daily chart above the 1260 area acted as an inflection point in the past. It is simply a strong pivot point. A price point where price tends to find strong support or resistance.

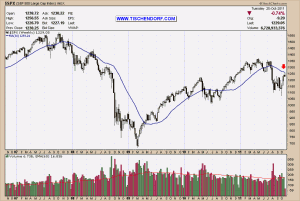

Chart is not part of my public list. Click to enlarge.

The weekly chart chart is hitting strong resistance as well. The simple moving average MA 30 is now acting as obvious resistance and exerting selling pressure.

Up-to-date S&P500 long-term weekly price chart on my public list.

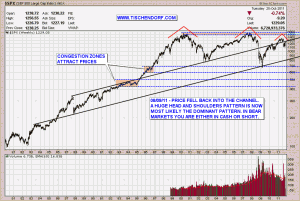

And finally the big picture technical analysis of the S&P 500 weekly chart showing the ominous head and shoulders pattern indicating potentially much lower prices ahead. The right shoulder can be viewed as a failed attempt to move above the trend channel I drew into the chart. Now price has fallen back into the pattern. This has long-term bearish implications.

Conclusion: This is definitely still not the right time for position traders to aggressively deploy funds on the long side. In this environment patience is key. Protecting and preserving your capital should be your main priority.

I don’t want to know too much about what a company is doing because I have found that the more I like a stock the more likely I am not to listen to the message of the market. – Tyler Bollhorn

My public list with all my charts can be viewed here:

http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID2791469

Buenas noches!