Tonight’s post is an update of my thoughts on Gold and the Gold Mining Stocks versus the Biotechnology Index and Biotech Stocks. The last time I mentioned Biotech was during my first Tischendorf Letter Audio Interview a few weeks ago. I thought the place to be in the near-term future was small to mid cap biotech stocks. The biotech stocks turned out to be one of the best performing sectors.

Here is why I think odds are very high for Biotech to continue to outperform and Gold and gold related stocks to continue to underperform. Click on the charts for access to more information in the annotations:

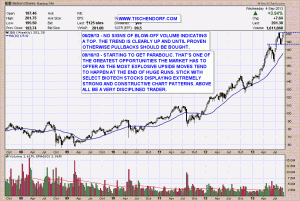

Up-to-date IBB – Biotech Index chart on my public list

IBB – the iShares Nasdaq Biotechnology Index Fund is clearly in an uptrend. The chart is trading very close to its all time high and is already showing signs of a parabolic move. Granted, parabolic moves are not for everyone but from a purely technical perspective this is the technical setting with the best odds for explosive moves to the upside. Put another way:

- In uptrends surprise moves tend to be to the upside

- In downtrends surprise moves tend to be to the downside

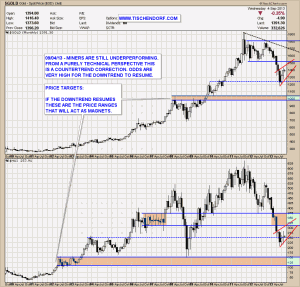

Up-to-date Gold vs. HUI chart on my public list

Conclusion: The low risk approach would be to avoid gold and gold related stocks as long as they trade below their MA 200 while seeking exposure to Biotech ETFs like IBB and XBI in order to avoid single stock exposure as long as the parabola is intact.

Administrative note: Twitter is not my main priority but I intend to tweet every now and then. You can follow me here:

Keep stock trading simple. You need only understand support, resistance, optimism, pessimism, price volatility and abnormal behavior. – Tyler Bollhorn