Today I bought a position in WLT and subsequently posted my thoughts on Twitter. WLT – Walter Energy a coal stock is offering a compelling short squeeze opportunity. The stock closed near its high of the day so that is a positive sign. If we get more follow through tomorrow and the stock proceeds to take out today’s intraday high at 6.51 we could witness a vicious short covering rally.

The rationale for a long entry is simple: If you are positioned on the short side you are shorting a stock that has gone nowhere but down for years. Earnings came out a few days ago. The stock initially went lower then refused to continue lower. Now it has printed a higher low and a higher high. The incentive to stay short if the stock keeps moving higher is very low. Hence going long is the path of least resistance. A close below today’s low at 5.81 invalidates the immediate short squeeze scenario.

The following charts suggest a price target around 8$. The daily chart shows a gap area that could act as a price magnet. The weekly chart allows for a mean reversion trade towards the weekly MA 30. If price slightly overshoots the weekly MA 30 we get the same 8$ target.

Daily WLT Walter Energy technical chart analysis. Click to enlarge:

Weekly WLT Walter Energy technical chart analysis. Click to enlarge:

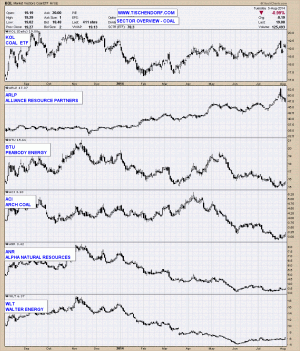

Coal Sector Overview Chart containing: KOL – Coal ETF, ARLP – Alliance Resource Partners, BTU – Peabody Energy, ANR – Alpha Natural Resources, ACI – Arch Coal, WLT – Walter Energy:

Don’t think about what the market’s going to do; you have absolutely no control over that. Think about what you’re going to do if it gets there. In particular, you should spend no time at all thinking about those rosy scenarios in which the market goes your way, since in those situations, there’s nothing more for you to do. Focus instead on those things you want least to happen and on what your response will be. – William Eckhardt

Twitter: https://twitter.com/Tischendorf

Investing in your education always pays. Learn how to read chart patterns like a pro! Tischendorf Letter Premium: https://members.tischendorf.com