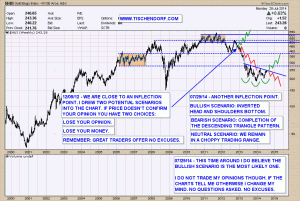

Interesting times ahead. The Gold Bugs Mining Index $HUI has reached another very important inflection point. As you can see in my annotations, this time around I do believe that the bullish scenario is the most likely one. If we get some more follow through this could trigger a sustainable up-move using the bullish inverted head and shoulders pattern as a launching pad. Obviously the other scenarios are either bearish or neutral. The bearish one would be the completion of a descending triangle in the making with a subsequent false breakout to the downside or total capitulation. The neutral scenario would be the continuation of a choppy sideways trading range until more pressure has built for a new trend to develop.

As I have stated numerous times, I do have strong opinions. But ultimately my trading decisions are based on price action. If a chart does not confirm my opinion I lose my opinion. It’s as simple as that. The past two years you really had a choice. You either lost your opinion or you lost your shirt.

Click on the chart to enlarge:

I bought an initial position in JNUG. No matter what you do, only put on positions that won’t make or break you. It is still early in the game. A new up trend, if it were to materialize now, will last for quite some time so there is really no need to rush things. Needless to say, JNUG is the most aggressive way to trade the bullish scenario and is not well suited for long term holding periods due to time decay inherent to leveraged ETFs. For all those who’d like to know more about what kind of trader I am listen to my latest Tischendorf Interview. For more interviews scroll down to the bottom of the column on the right.

The one thing I want you to keep in mind is to be fearless and to go for it if you see a set-up. The key is to be disciplined and to master your ego. Have the courage to simply change course and lose your opinion if things do not unfold as expected. Although I’ve used this quote in the past I will use it again as I think it captures the essence of ‘Inflection Point Scenarios’ and professional trading:

We’re in the business of making mistakes. Winners make small mistakes, losers make big mistakes. – Ned Davis

Twitter: https://twitter.com/Tischendorf

Investing in your education always pays. Learn how to read chart patterns like a pro! Tischendorf Letter Premium: https://members.tischendorf.com