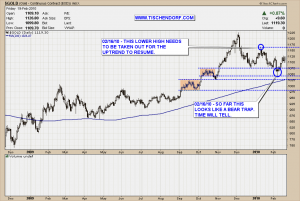

A few thoughts on the state of the gold bull market. We are stuck between two important pivot points. I used blue circles in the chart to illustrate them. After taking out one of these levels my best guess is we will witness some decent follow through. As a technical trader you want to be cautious and wait until the charts confirm a hypothesis and then simply react to the chart’s message.

That being said I am starting to mentally prepare for a breakout to the up-side. The recent price action is bullish as lots of stuff suggested lower prices ahead:

- The dollar is moving up.

- Interest rates rise.

- IMF Gold selling announcements.

And then some. George Soros being quoted calling gold the ‘Ultimate asset bubble’. Then followed by an announcement he doubled his gold (GLD – ETF) holdings. I’ll spare you the details. This is the usual blah, blah, blah, deception, lies and crap served on a daily basis. If you want to know the truth my advice is the following: Learn to read the charts – forget everything else. I haven’t drawn in the obvious bullish wedge like everybody else. The pattern is valid but my focus is on those horizontal lines delineating the levels the gold price has to take out.

Up-to-date Gold Price Chart on my public list.

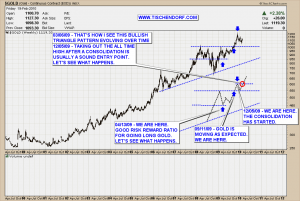

As mentioned in a previous post describing the various scenarios I see going forward the most prudent thing to do is to wait until the Gold highs get taken out. I used a red circle in the idealized chart below. You will have to pay more but you will get additional confirmation. Odds the bull market in gold has come to an end will then be very low. New all time highs should always be interpreted as very bullish action. Winners like Ed Seykota are known to be more than willing to buy new all time highs.

Up-to-date Weekly Gold Price Chart on my public list.

Keep in mind Gold is trading less than 10% below its all time high. We have a situation with extremely low overhead resistance. That means the potential for explosive price moves to the upside are a high probability outcome. The charts will tell me what to do. You may want to review Jesse Livermore’s advice on what to do in a bull market.

Experienced traders control risk, inexperienced traders chase gains. – Alan Farley

Have a great weekend!

{ 8 trackbacks }

Comments on this entry are closed.